Keeping your customer’s funds safe

Safeguarding is a mission critical requirement of any Fintech.

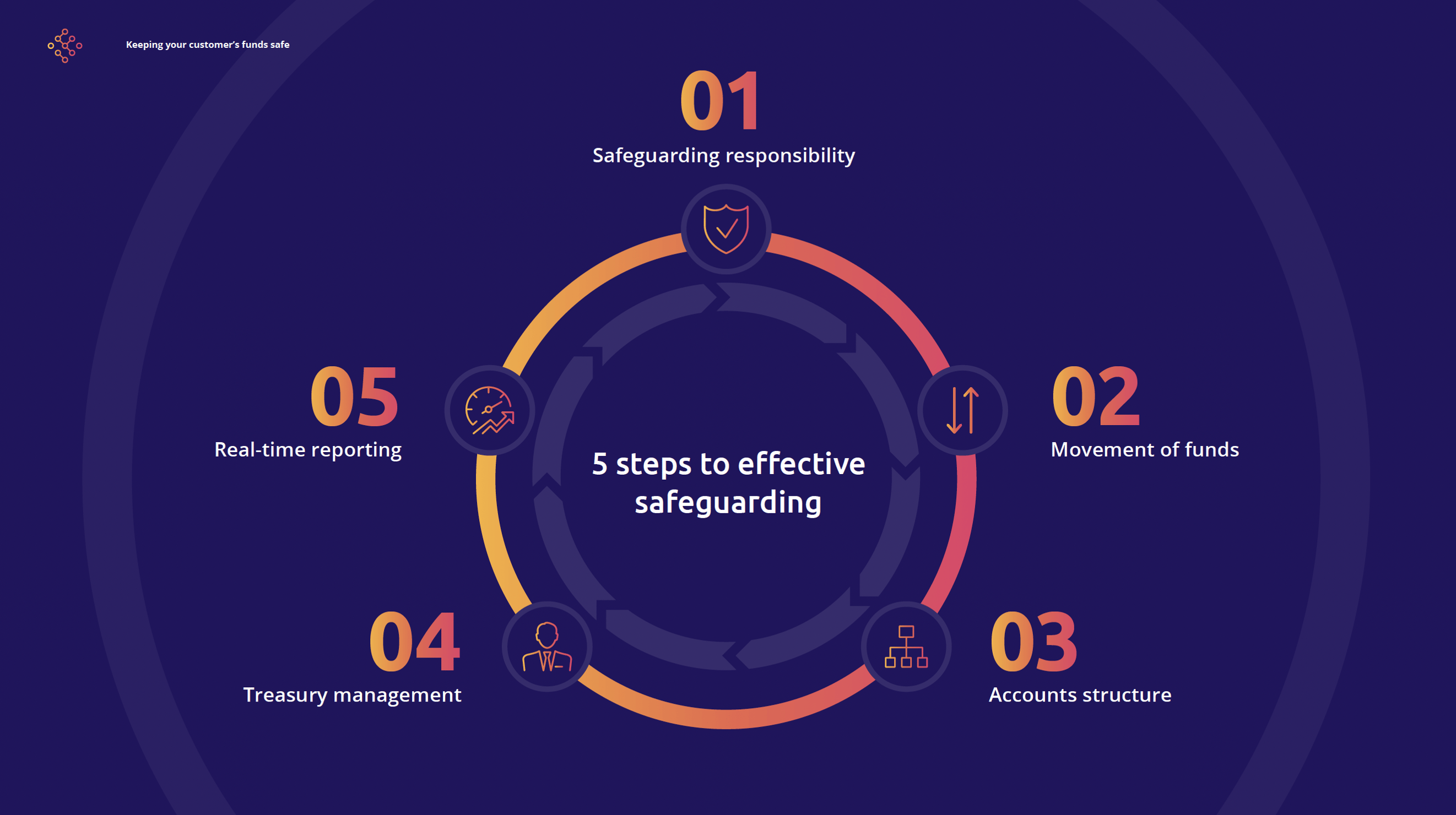

Five steps to effective safeguarding.

If you are in the trenches trying to bring your Fintech to life, how you will tackle the protection of client assets once you finally have customers might not be top of mind.

However, it’s one of the top priorities of regulatory framework and creating the right structure and process to address and execute good safeguarding practices will make sure you remain on the path to success.

“A separation of funds is paramount to a Fintech, knowing what money is where at any given time and enables a high degree of back office, treasury automation. From setting this strong foundation, a new business can add new users and scale quickly with the confidence that, no matter what happens down the road, the security of client money is at the heart of their organisation.“

David Reiss, Programme Director, Strategic Partnerships

Currencycloud

Content preview

An operator’s guide to planning, executing and managing safeguarding effectively.

Building a Fintech is an exciting time as founders look to bring their vision to life. However, it is not as easy as one might expect. The process is riddled with quirks and nuances most of which wouldn’t have been considered at “white paper” stage, but end up altering plans and or procedures. One such example is Safeguarding (of customer funds), which is often overlooked at the early stage but will play a pivotal role in licensing and launch.

What is safeguarding?

Once you have launched your Fintech in the public domain and are onboarding customers you are required to take steps to safeguard “Relevant Funds”, i.e. sums paid to you by your customers. Safeguarding is ultimately about protecting customers by ensuring clarity on who is owed what.

The regulator requires you to safeguard Relevant Funds in one of two ways:

1. Relevant Funds must either be segregated from other funds by placing them in a designated, separate credit institution or investing them in secure, liquid, low-risk assets held in a separate account with a custodian, or;

2. Coverage via an insurance policy, the proceeds of which are paid into a segregated bank account in the event of insolvency.

Why safeguarding is different?

Unlike the FSCS insurance scheme, where a customer’s funds are insured up to a certain value (£85,000), safeguarding is the preservation of 100% of the funds paid by the customer into an account with an Electronic Money Institution (EMI) and / or a Payment Institution (PI). There is no upper limit to safeguarded funds.

Consequences of not-complying

It is imperative that any company processing or holding funds on behalf of third parties is able to provide high-quality information to its executive team with regards to their client money obligations at any time. Failure to supply this information (and of course the money available to the value required to reimburse customers) will can result in hefty fines from the FCA and possibly legal action. It is therefore imperative to understand why you need to safeguard funds, how you do it and how to optimise managing the process.

Where to deposit funds?

Suppose you have a financial licence, such as a PI or an EMI. In that case, customer funds need to be held in a designated segregated account that is only provided by certain types of credit institutions. It ensures that should the event arise whereby someone other than the firm needs to redistribute funds back to customers, they can take control of the account.

Five steps to effective safeguarding

From theory to action - the following sections provide practical considerations for building an efficient safeguarding framework...

Unlock full content

Get your copy

Download the full e-Book